25 February 2019

Cash no longer king! Mobile banking still rising

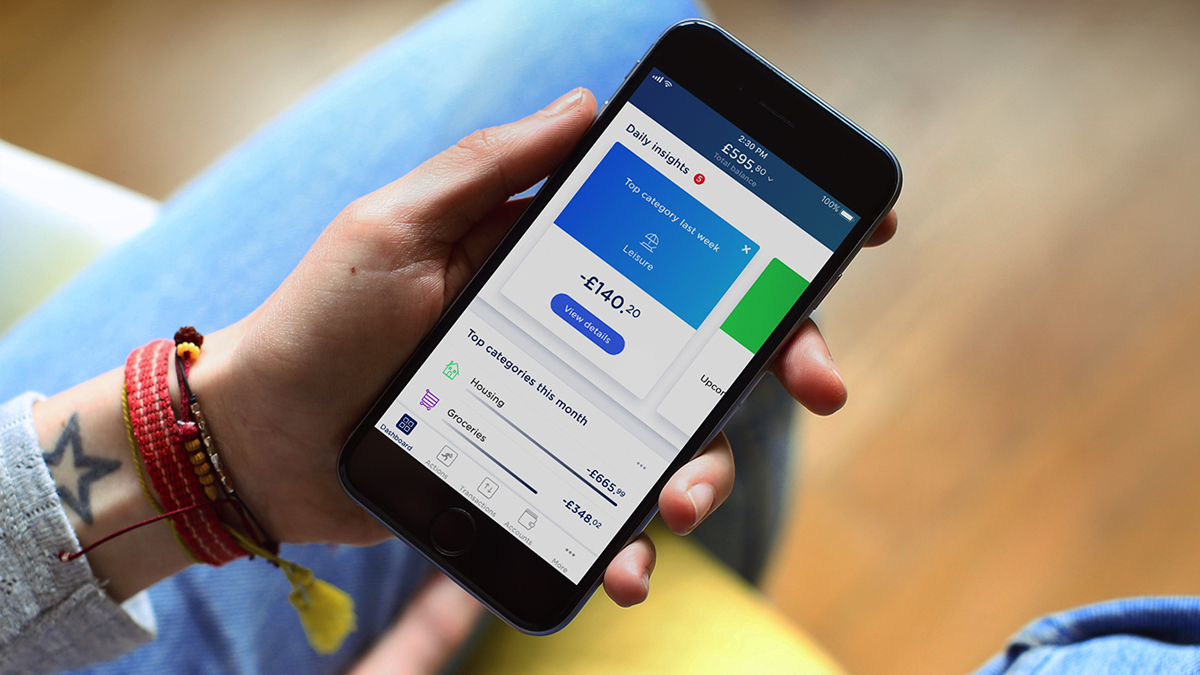

Mobile banking is maturing, with longer term users in Europe showing signs their money management is getting better and better.

Mobile banking is maturing, with longer term users in Europe showing signs their money management is getting better and better.

Payconiq launches its first TV commercial in Belgium on the simplicity of mobile payments.

ING Direct Spain’s new service ‘Twyp Cash’ is live as of today. Customers can now withdraw money with their smartphone when paying for other purchases at more than 3,500 supermarkets and gas stations.

ING’s growing force of private bankers are winning the hearts and minds of customers across the Netherlands by using unconventional strategies. So what’s it like to be a private banker these days? Here’s Maarten Telnekes from the Netherlands Apeldoorn-Achterhoek region.

ING does about 6,000 wholesale banking transactions each year. How do we make sure none of them pose too much risk to the environment, people and communities? And how do we help clients become more sustainable? Meet the ESR team.

Europeans divided on the use of cryptocurrencies

How one small Dutch company is changing the world of solar panels.

UK-based money management platform Yolt is being expanded to France and Italy following an announcement today by ING.

ING is fifth in the 2017 list of world’s 100 most sustainable corporations. The ranking is done by Corporate Knights, the world’s largest magazine focused on sustainability and responsible business.

ING Group has been notified of the European Central Bank (ECB) decision on the 2018 Supervisory Review and Evaluation Process (SREP), which will set the capital requirements for 2019. The common equity Tier 1 requirement for ING Group will be 11.8% in 2019.