Home ownership dream fading

20 September 2018

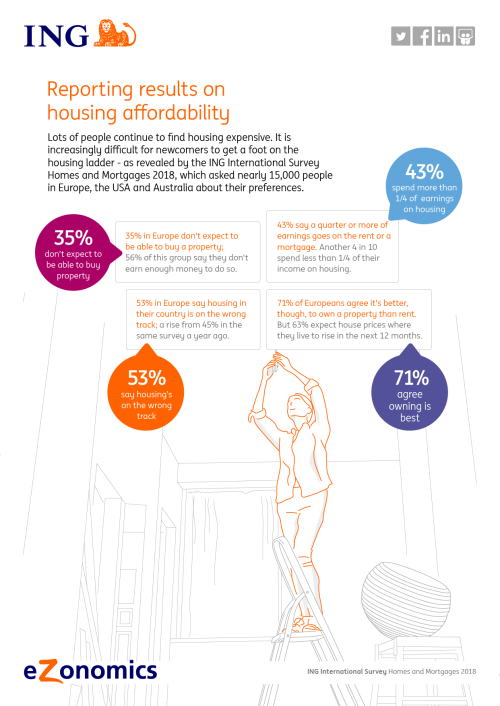

Almost two-thirds of renters and non-home owners in Europe (65%) feel it’s become harder to get on to the housing ladder since 2015, while one in three (35%) expect to never buy at all due to soaring rental costs, low wage growth and high property prices.

This is the finding of the seventh annual ING International Survey (IIS) on Homes and Mortgages. We asked almost 15,000 people in Europe, Australia and the US about the housing market in their country, how much of their monthly salary is spent on their mortgage, and how optimistic they are that things will improve.

“Many perceive the housing market as expensive and unfair, a trend that is particularly concerning given the concept of a home encompasses so much more than bricks and mortar,” says Jessica Exton, behavioural scientist at ING.

“Expectations of future price rises will likely fuel the growing level of discontent regarding housing in Europe.”

Unsurprisingly, more than half (53%) of the respondents say their country is on the wrong track with housing, up from 45% last year. Yet 71% still agree it’s financially better to own a property than rent.

Affordable homes out of reach for many

This year’s results suggest it may be tough for people of all ages to buy a home. People feel they do not earn enough to buy a house and have little chance of earning more in the future (particularly those aged over 55). Income is uncertain and already high housing prices are expected to increase even further.

Just 34% of Europeans say it’s easy to cover their monthly rent or mortgage, with 13% spending half their take-home pay on housing.

It’s especially hard for first-time buyers, according to a majority of respondents in the 15 countries surveyed (78% in Australia, 72% in Europe, and 64% in the US).

“Many younger Europeans feel priced out of the market and frustrated about their chances of buying a home in the next five years,” says Maria Ferreira, ING senior economist.

Only nine percent of non-home owners expect to buy their first property before they turn 30. On average, Europeans expect to own their first home by the age of 34. The majority of young people (64%) move from their parents’ into rented accommodation with a partner or friends.

Across Europe, 13% say they have more than two generations living in their home, mainly to save money.

Read the full ING International Survey (IIS) on Homes and Mortgages 2018, or visit www.ezonomics.com/iis.