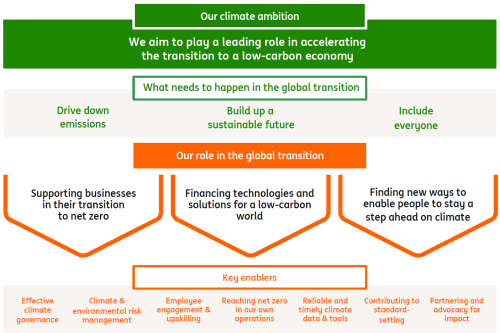

Our climate approach

The urgency of climate change is only growing and ING wants to play a leading role in accelerating the global transition to a low-carbon economy.

At ING, our ambition is to help accelerate the transition – because it matters to us as a bank, to our clients and customers, and to society. Our role in the global transition is focused on the three areas where we believe we can make the greatest impact, based on what needs to happen in the world:

What needs to happen in the global transition

Driving down emissions: supporting businesses in their transition to net zero

To drive down emissions and align with global climate goals, we believe that the most significant contribution we can make is through engaging with our clients to help them accelerate their transition.

For clients in the most carbon-intensive sectors, we realise their ability to shift can make the greatest difference. In 2018, we started what we call our Terra approach to set pathways for key sectors to reach net-zero emissions by 2050 – with intermediate 2030 targets. Terra is based on data and climate science and uses what we consider to be the best-fit methodology per sector. We continue to broaden Terra to have more impact, working to include additional carbon-intensive sectors and other parts of the value chain of already in-scope sectors.

The intermediate 2030 science-based targets we have set under Terra have been validated by the Science Based Targets initiative (SBTi), according to SBTi’s updated framework for banks (known as FINT Criteria V2), which came into effect end-November 2024. See full details of ING's SBTi-validated targets.

We’re also continually strengthening how we engage with our clients as they move to implementation of their climate transition planning, and we will report transparently on progress each year.

As society transitions to a low-carbon economy, so do our clients, and so does ING. The low-carbon transition cannot happen overnight. Even though we finance a lot of sustainable activities, we still finance more that’s not, which is a reflection of the current global economy.

Building up a sustainable future: financing technologies and solutions for a low-carbon world

To make the energy transition a reality, there’ll need to be trillions of euros of investment. We have a role to play here too, in financing the new low-carbon technology to meet net-zero goals – like renewable power, green hydrogen, energy efficiency, and energy storage. Building up the affordable supply of green energy alternatives is a necessary and powerful driver in reducing society’s dependence on fossil fuels.

Whether our clients are developing breakthrough technologies, new approaches to energy, waste and water management, or constructing green buildings and infrastructure, right across the bank we’re working to enable them to pursue their sustainability ambitions. We are using innovative financing solutions – from pioneering the world’s first sustainability linked loan back in 2017 to our leading-edge efforts today in working to make the supply chains in and across industries more sustainable.

Including everyone in the transition: finding new ways to enable people to stay a step ahead on climate

At ING, we believe that most people want to play a positive part in the transition to a more sustainable future. We aim to keep finding new ways to enable people to stay a step ahead on climate. For example, through our mortgage portfolio, we finance the homes of a large number of people and that gives us the opportunity to help them to do that. We incentivise green home ownership through the mortgages we offer and are working towards having sustainable alternatives to all our main retail products by 2025. And, recognising the great challenge of retrofitting existing housing stock, we’re increasingly supporting customers to upgrade their homes to become more sustainable and energy-efficient, as well as reducing their cost of living.

A dynamic landscape

Climate change is a complex and dynamic challenge, so our response needs to be dynamic as well. Just as scientific understanding is continually advancing, so our approach must keep evolving. Our focus is broadening to consider not only climate change mitigation but how we can also support climate adaptation. Responding to the climate crisis is not only about urgent action on the environmental impacts but also on the human impacts. With risks to life and livelihoods growing for people all over the world, we are actively working to support a fair and inclusive transition that respects human rights. Meanwhile, in the face of biodiversity collapse, how to protect and regenerate natural systems is now an urgent concern globally. Safeguarding nature also supports climate mitigation and resilience, and ING is integrating nature into the processes we already have in place for climate action.

None of these challenges can be tackled in isolation. There are many interdependencies and new solutions will require a systems-wide approach. So, it will be ever more important that, at ING, we are clear about the changing nature of the risks and opportunities ahead and keep reassessing how and where our efforts can have the greatest impact over the short, medium and long-term horizons.

Partnering for progress

The transition to a low-carbon economy has no single, simple solution. This is why progress can only be driven through concerted, collaborative action. We are eager to work with many different types of organisations wrestling with these difficult questions, from shaping policy agendas to creating innovative solutions. We will share what we learn along the way, so we can all move faster. And, together with our partners, we’ll advocate for the systems-level change that is needed.

The experience and expertise on climate that we have built across the bank give us a springboard to keep pressing forward and increasing our impact. It is our ambition to play a leading role in accelerating the transition.

See our most recent Climate Progress Update and our Summary for policymakers for more information on our advocacy actions to engage with governments and policymakers for the Terra sectors.

What’s the deal with fossil fuels?

We are gradually reducing financing of fossil fuels in line with international climate guidance. However around 80% of the world’s energy still comes from fossil fuels for things like heating, cooking, transportation and electricity. And while decarbonisation is crucial, the same is true for energy remaining affordable and the supply remaining secure.

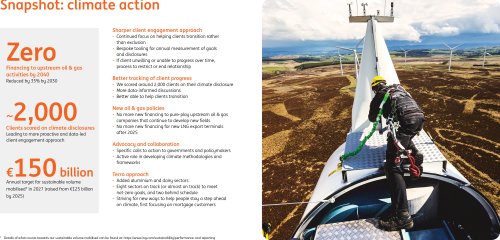

We take a sector-by-sector, science-based approach and have already made important policy decisions when it comes to fossil fuels. We’ve accelerated the phasing out of financing upstream (exploration and production) oil and gas activities. These loans will be reduced by 35% by 2030 and will be zero by 2040. That’s ten years sooner than most scenarios.

We’re also reducing the financing of coal-fired power plants to close to zero by 2025, we stopped the general financing to so-called pure-play upstream oil & gas companies that continue to develop new oil & gas fields and restricted the financing of the midstream infrastructure that supports the development of those fields.

Guided by the IEA World Energy Outlook 2023, we've decided to stop providing new financing for new LNG export terminals after 2025.

The best way to reduce fossil fuel demand is to increase the availability of renewable energy. More than half of our power portfolio is already renewables and we set a target amount of €7.5 billion in annual renewables financing by 2025, which is a more than tripling of the-previous-target.