Global shipping outlook: It’s all about capacity as the tide turns

This article is a copy of the original article on Think.ing.com

The outlook for shipping remains mixed. Cargo growth is weak, but capacity is currently the most important factor to watch. While the container segment is bracing for a flood of capacity, the order book for new tankers is still limited. Combined with recovered oil demand and longer trade routes, the market remains tight, leading to prolonged higher rates

Global trade is changing and so is shipping

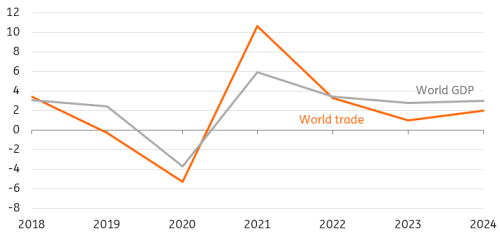

Global trade slipped into contraction at the end of 2022, following the rationalisation of piled-up inventories and the economic and industrial stagnation in the US and Europe. Global trade has also entered a period of lower growth due to geopolitical concerns, protectionism, and supply chain reconsiderations. Growth is therefore set to remain low into 2024 and this means that shipping tonnage is also under pressure. Nevertheless, we still expect a stronger second half of 2023 once consumer spending on goods picks up alongside a normalisation of spending patterns, reduced inventories and wage growth.

World merchant trade growth to lag GDP development in 2023-24

(Development volume in % YoY)

IMF, CPB, ING research

Against the backdrop of faltering economic growth in advanced economies, and emerging economies returning to their trend growth, trade activity is unequal across the world. Consequently, the development in intra-Asian traffic is likely to exceed the global average in 2023 and 2024, and the Middle East and Africa will follow suit. Therefore, regional deployment across the globe will make a difference in carrier performance.

Faltering trade isn’t the full story: longer trade routes push shipping demand higher

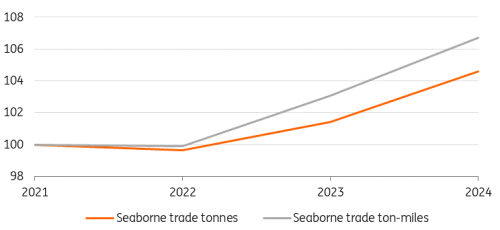

Shipping activity is holding up better than world trade figures suggest, specifically on the (liquid) bulk side. The massive reshaping of shipping routes following Russian sanctions – which we explain in more detail here – has led to significantly longer mileages. Russian oil, gas, coal, iron ore and metals trade are still finding their way to markets, but to different buyers. With sanctions on Russian commodities coming into effect in batches, this will materialise in 2023 when seaborne ton-mileages are expected to gain more than 3% compared to a year earlier, which is more than the 1% trade growth we expect. With no signs of a reversal in policy, these extra miles will remain in place in 2024.

Trade is sailing longer distances following sanctions on Russia

Global seaborne trade growth (2021 = 100)

Clarksons, ING Research

Tanker shipping is holding up better

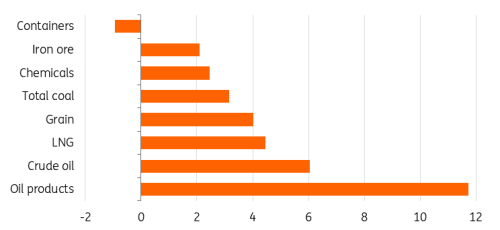

The impact of longer routes is most prominent in tanker shipping, with Russian oil flowing to China and India at a discount instead of making a short haul to Europe. Western countries (G7) on the other hand have shifted away from importing Russian crude and oil products, and have started to import more crude oil from Saudi Arabia and the US and refined oil products like diesel from India. This is pushing the expected growth in global oil product shipping up to double-digit levels in 2023, while tonnage demand will increase by just 4%. Similarly, crude trade is being pushed up and to a much lesser extent this also impacts dry bulk shipping (coal, iron ore).

Oil product shipping demand will see a continued rebound in 2023

Seaborne trade growth forecast in tonne-miles (% YoY) in 2023

Clarksons, ING Resarch

Challenging market dynamics in container shipping follow historic boom

Container shipping will leave the extraordinary pandemic years behind in 2023. A combination of high demand for consumer goods and multiple supply interruptions sent rates and profits to unprecedented levels over the last two years. But this is changing rapidly now. With a mix of demand adjustment (and a mild contraction in 2023), resolved port congestion and a range of newly-ordered vessels coming online, elevated spot rates have plummeted as the market power shifts to the buyer side. After two exceptionally profitable years, container liners are financially resilient though. Find our analysis for the container sector here.

Global bunker fuel prices in shipping have come down after 2022 highs

Bunker fuel prices (Rotterdam) in $ per tonne

Clarksons, ING Research, last data point 6/9/23

Bunker prices are down against an inflationary backdrop

Shipping companies also face higher general price levels, but the costs of the most important cost fraction have come down. On most occasions, the charterer pays for the fuel, but exposure also depends on contractual arrangements, and container shipping carriers usually pay the fuel bill. So, price development does make sense. Compared to 2022, heavy fuel oil (HFO) prices (burned in combination with scrubbers) traded about 30% lower than a year earlier in the first half of 2023. Low sulphur-compliant fuels like VLSFO (very low sulphur fuel oils) and MGO (marine gasoil) have dropped more significantly compared to last year, leading to narrowed fuel spreads. This makes the case for installing scrubbers (in 2022 on 13% of the global fleet) less attractive, although pressure on results could lead to revived attention for the cheapest fuel. The oil market remains strained though and price risks remain skewed to the upside.

On the back of an increasing number of dual fuel vessels in the fleet, it’s also relevant to look at liquefied natural gas (LNG) prices. Over most of 2022, LNG propulsion was very expensive and probably out of sight as an alternative for most companies. Prices have fallen steeply to $500 per tonne this month, but the increased global demand and the rush to attract LNG to replace piped gas in Europe still weigh on the attractiveness as a fuel and upward price risks for the rest of 2023 remain.

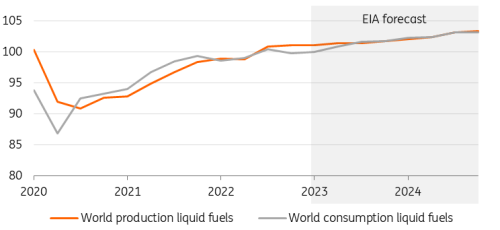

Tanker shipping to continue to benefit from a tight market

Contrary to container shipping, the liquid bulk market is enjoying strong fundamentals. Global oil usage is expected to grow more than 2% year-on-year in 2023, and having recovered from the pandemic global jet fuel consumption soared about 30% in the first half of this year. But the most impactful is the recalibration of trade routes following the sanctions imposed on Russia. This turned into a less efficient deployment of the fleet and the creation of a significant ‘shadow fleet’ of generally older tankers operated on behalf of Russia as G7 countries agreed not to ship any Russian crude oil products below the $60 cap. Find our views and forecasts for the oil market here.

Tanker trade flows expected to see ongoing moderate growth in 2023-24

Global liquid fuel production/consumption volume (mln. bbls per day)

EIA

Scrutiny of new tanker investments leads to structural capacity tightness

With lifecycles exceeding 20 years, potential investors in new-build tankers are increasingly wary of energy transition risks (stranded assets) and peak oil is expected for 2028, although current oil demand is still strong. The total tanker order book level in 2023 reached its lowest level since 1996. There are hardly any very large crude carriers (VLCC) on order (in June there were just 12, which is 1.3% of the total installed base). The demolition of tankers almost came to a standstill in 2023, with Russia also seeking capacity, but it will also turn relevant for market players to extend the lifecycles of existing tankers. This will probably also translate into stronger second-hand prices.

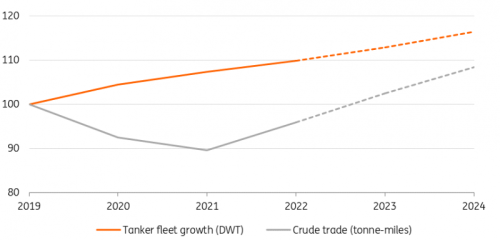

(Crude) tanker trade capacity is tightening

Index growth tanker fleet (DWT*) vs crude trade growth (tonne-miles), 2019 = 100

Clarksons, ING Research *dead weight tonnage, tanker fleet excluding product tankers

Tanker market fundamentals remain strong

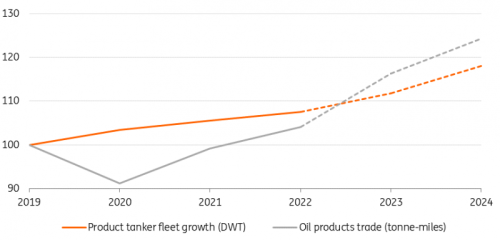

Looking at low order books, current fleet inefficiencies and the expectation that global demand for oil products won’t reach a turning point over the next few years, the market will continue to be tight and profitable for tanker owners and operators. This especially holds true for product tankers. Orders of new product tankers have so far picked up in 2023, but strong shipping demand on longer journeys exceeds capacity, meaning utilisation rates and market pressure is rising.

Product tanker demand exceeds capacity growth

Index growth tanker fleet (DWT*) vs. oil products trade growth, 2019 = 100

Clarksons, ING Research *dead weight tonnage

Tanker rates expected to remain elevated

In the run-up to the Russian invasion of Ukraine and subsequent sanctions, tanker rates started to rise rapidly. Despite easing since, rates remain relatively high (around $40,000 per day, over double the 10-year average). Trades to Russia (within the oil price cap) currently generate substantial premiums for shipowners. Based on the current tight market dynamics, tanker rates are set to remain strong.

Of course, the oil market always remains subject to uncertainty and volatile oil prices. New policy interventions are possible and strong sways in oil prices could lead to more or less floating storage which proved to have a strong impact on tanker market rates in 2020 when a strong contango led to price spikes.

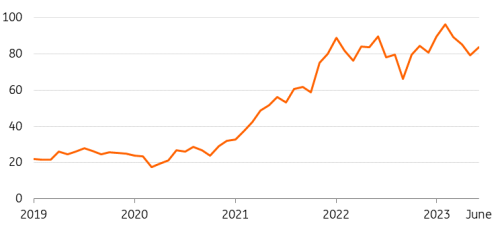

Tanker rates still strong on tight capacity mid-2023

Average tanker earnings in $ per day and crude oil price (Brent)

Clarksons, ING Research

Rush for LNG leaves tanker fleet tight, but massive inflow of new capacity is coming

The LNG tanker market has drawn quite some attention recently. Demand for LNG shipping has been strong this year and will rise again by more than 4% in 2023. Growth is being supported by the reopening of the important Freeport European countries seeking to replace Russian piped gas imports, which has pushed up demand and many new (floating) terminals are being realised and planned. In Asia, China and Japan are large importers of LNG. For exporting countries, particularly the US and Qatar, and also many African countries, production investments are made to raise production.

For LNG carriers though, there’s a significant order book which exceeds 50% of the current fleet in June 2023 (330 vessels). Most of them are being delivered by a few specialised shipyards, which has pushed prices for new 170.000 M3 tankers up from around $200m to $250-260m. Most of them are set to be delivered from 2024-26, which will lead to a double-digit annual expansion of fleet capacity in those years.

Global economic slowdown tempers volume growth of ore and coal

Dry bulk shipping handles a diverse mix of cargo but generally leans heavily on global industrial activity. Production struggles will grow amid faltering consumer demand and higher interest rates curbing investment activity in the Western world. Seaborne trade of iron ore and coal is highly dependent on Chinese industrial production and the reopening of Chinese factories helped volumes to grow in 2023. But the economic rebound in China, and thus steel demand, has been weaker than expected. So production remains significantly lower in 2023 than its 2020 peak level.

But Chinese domestic demand supports bulker flows

Bulker trades are benefiting from domestic demand in China this year, which is also being stimulated by the government. Despite climate pledges, China continues to open coal-fired plants for energy purposes (no less than 50 in 2022), leading to extra thermal coal demand.

China lifted the ban on coal and iron ore from Australia, which is relevant for bulker routes, although the net impact in terms of tonnage of this is limited as trades were shifted to Indonesia and other parts of the world.

In Europe, coal has made a temporary comeback due to the energy crisis, but demand may be tempered again in 2024 if Europe is able to wean itself off Russian gas.

Moderate growth in 2023, weakening in 2024

All in all, total global coal tonnage is expected to rise by 2% with a 3% expansion of tonne-mileages on the cards. In 2024, volumes are expected to grow only slightly. The World Steel Association expects global steel demand to be flat in 2024. In the longer run, coal trade (about 10% of total tonnage) will weigh on the bulker market perspectives as demand for thermal coal will probably start to slide after 2025.

Grain trade holds up relatively well

A smaller dry bulk segment – grain – was drastically disrupted in 2022 with the blockage of Black Sea ports. Uncertainty and fragility still remain with the rollover of short-tenor agreements. Nevertheless, ports are more accessible and global grain trade is thus far better in 2023 (+4%). Without new significant interruptions, a similar increase in tonne-miles is expected for 2024.

Car carriers currently operate in an outperforming niche market in shipping. This has happened on the back of a production recovery and the rise of electric vehicles. Asian electric vehicle brands like Hyundai/Kia and BYD are gaining market share in Europe and other parts of the world, with vehicles produced in Asia. Car carriers like Höeghs and Wallenius Wilhelmsen are benefiting from rising export figures, which is also visible at Europe's largest port for overseas car imports, Bruges. These flows also have upward potential in the short run. An important factor here is that capacity can’t be lifted as there are hardly any vessels on order.

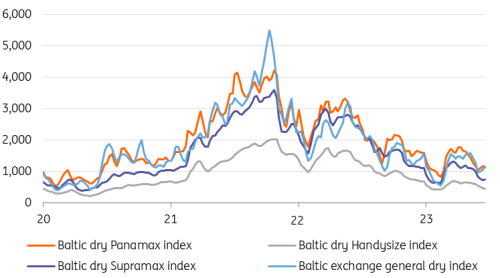

Dry bulk rates softened significantly compared to 2021 and the first half of 2022

Baltic dry indices bulkers

Clarksons, ING Research, last data point 06/23

Bulk rates on the weak end after a gradual decline

Bulk rates came down last year on slowing demand growth. This month, a one-year charter for a Panamax 75.000 DWT bulker was priced at $13,750 a day, which is around the 10-year average. This isn’t strong when corrected for inflation. Weak expected demand growth for 2024 limits the upward potential for rates.

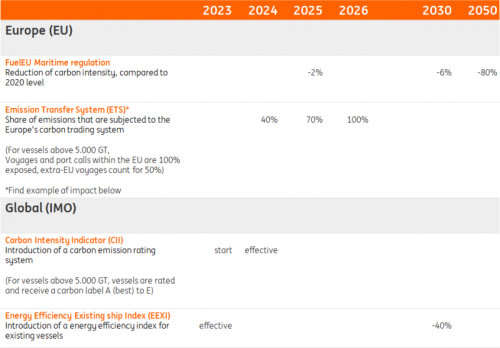

Multiple sustainability regulations are coming into force and affect existing vessels and shipping companies

ING Research

European carbon prices are significantly higher

Carbon spot price Europe (ETS), € per ton

Refinitiv, ING Research

ETS could add 50% to fuel costs for intra-European journeys

Assuming one ton of VLSFO emits around 3.15 tons of CO2, a CO2 price of €80 per ton and a VLSFO price cost of $500 could push up fuel costs by more than 50%. Based on the vessel type, specific trip and port calls, as well as fuel costs and actual CO2 prices, this could push up costs of East-West journeys by more than 20% in 2026. Operators and shipping companies will (largely) pass on these costs to charters and shippers. Carbon pricing provides a stimulus to reduce CO2.