Decarbonisation of petrochemicals needs more cross-sector effort

This article is a copy of the original article on Think.ing.com

Plastics, rubber and fertilisers are used in almost every aspect of our lives, but they have a large climate impact. In this article, we explore multiple pathways for decarbonisation along the full value chain. Regulations, incentives and end-use companies’ sustainability mandates will all drive the change

Petrochemical products, such as plastics, rubber, and fertilisers, are the building blocks supporting our day-to-day activities. Because of their huge contribution to the global economy, petrochemicals are the biggest driver for near to medium-term oil demand increase.

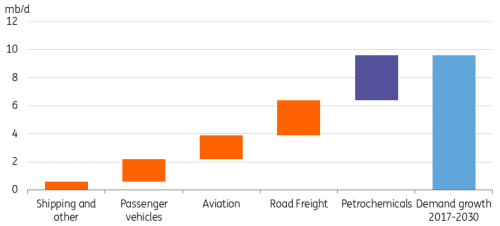

Petrochemicals are expected to contribute most to oil demand growth leading up to 2030

Oil demand growth by sector in million barrels per day in the IEA Reference Technology Scenario

ING Research based on IEA

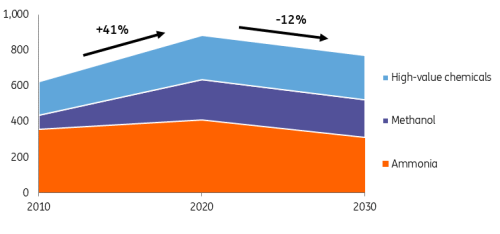

The petrochemicals sector is also hard-to-abate with currently commercially available technologies. The sector's direct carbon dioxide (CO2) emissions grew by 41% between 2010 and 2020, despite the fact that carbon intensity has stagnated over the past few years. To reach net zero emissions by 2050, the sector’s direct emissions need to decrease by 12% between 2020 and 2030—and then be reduced even faster with maturing low-carbon technologies.

Direct carbon dioxide emissions have grown by 41% and need to decline by 12% by 2030 on a net zero trajectory

Direct CO2 emissions from primary chemical production in megatons CO2-equivalents per year

ING Research based on International Energy Agency's (IEA's) Net Zero Scenario

With the increasing urgency to combat climate change and manage associated physical and transition risks, the petrochemicals sector is feeling the need to decarbonise. Decarbonisation pressures are also coming from the end of the value chain, including companies that use petrochemicals for their own products, such as packaging in the food and beverage and retail industries (more examples will be provided later on).

This article examines what the main decarbonisation pathways are for the petrochemicals sector, as well as what companies in this industry have been doing to boost their sustainability practices.

What are petrochemicals?

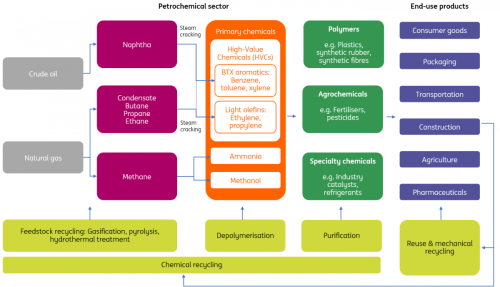

In general, petrochemicals are chemical products that are made from oil or natural gas. Petrochemicals currently represent 90% of the total demand for feedstock in chemical production. Relevant oil and gas products are turned into primary chemicals such as high-value chemicals (HVCs, including aromatics and light olefins), ammonia, and methanol. These primary chemicals are then processed into final petrochemical products that are applied across sectors such as consumer goods, packaging and agriculture, among others.

Petrochemical sector value chain

ING Research, International Energy Agency

Sustainability mandates from consumer goods companies drive decarbonisation in petrochemical products

Plastic, for example, is a popular petrochemical product that is widely used across industries. Packaging is the biggest contributor to plastic consumption, taking up a 36% share. As companies in the consumer goods industry have become increasingly aware of managing Scope 3 emissions along the value chain, they have formed strategies to partner with petrochemical companies to use bio-based and/or recycled plastics for packaging.

Packaging is the largest contributor to plastic consumption

Estimated consumption of plastic by end-use sector

International Energy Agency

In the luxury goods industry, for instance, LVMH Beauty (a division of LVMH) is collaborating with Dow to ramp up the use of sustainable plastics to produce items such as premium perfume caps and cosmetic cream jars. In the food and beverage industry, chemical company Avantium has been partnering with companies such as Coca-Cola to produce bioplastics at scale. Moreover, food processing company Heinz and retail company Tesco have entered a trial programme with Plastics Energy, SABIC, and Berry Global to collect used plastic, convert it into oil feedstock, and reproduce plastic for recycled use.

Petrochemical companies say that demand from end-use sectors has been a powerful driver for them to decarbonise production—and this trend is likely to continue in the future if companies remain serious about reducing carbon emissions. The decarbonisation of petrochemical products, therefore, is no longer a process within this one sector, but a highly collective one along the products’ value chain.

Multiple decarbonisation pathways possible for exploration

What are some of the main pathways petrochemical companies can undertake to decarbonise?

- Biobased feedstocks

Using biobased feedstock to replace fossil feedstock in the production of petrochemicals has been a relatively common practice that has existed for a long time. This is partly because of the relatively low cost of doing so.

Aromatics and light olefins can be produced from bio-naphtha, which is a by-product of the process of renewable diesel or sustainable aviation fuel production. Companies such as INEOS, ENI, and BASF are already producing bio-naphtha and are planning for more.

Olefins can also be produced sustainably using other bio-based feedstock. For instance, bio-polyethylene, a building block of plastic, can be produced from ethanol. Because of the higher yields and lower cost, the majority of bio-based feedstock is first-generation feedstock such as sugarcane, corn, etc. The biggest problem of first-generation feedstock is that chemical producers need to compete with demand from the food industry, as well as (in some cases) companies of other oil products that are looking to decarbonise. Overfarming can also lead to environmental concerns.

That is why more effort needs to be made towards using second-generation feedstock (e.g. animal fats, bio waste, waste vegetable oil) and third-generation feedstock (e.g. algae, cellulose). LyondellBasell and Neste announced in 2019 that they had started joint production of bio-based polypropylene and bio-based low-density polyethylene from materials such as waste and residual oil on a commercial scale. According to the International Energy Agency, achieving net-zero emissions by mid-century requires 60% of the global bioenergy supply in 2050 to come from sources that do not need dedicated land use.

- Recycling plastics and enhancing circularity

Plastic recycling is an area that has great potential for improvement because of current insufficient efforts. Globally, just 9% of plastic waste is recycled every year, according to the Organisation for Economic Co-operation and Development (OECD). The OECD also forecasts that under business-as-usual conditions, global plastic waste would almost triple by 2060 and only less than 20% would get recycled. This highlights the importance of ramping up recycling and building a circular plastics value chain.

There are several ways to close the loop for the plastics value chain: reuse, mechanical recycling, and chemical recycling. Reusing means that a plastic product gets consumed again, though this method remains limited in scale. Mechanical recycling refers to crushing and melting plastic and turning it into another product without changing the plastic's chemical composition. Mechanical recycling can work well with high-quality plastic, but the amount of plastic that can use this method is relatively small, and it doesn't really close the loop for the value chain.

Closing the loop for circularity

ING Research, International Energy Agency

Companies have been increasingly working towards chemical recycling, a more advanced process where chemical molecules can be broken down again to feedstock levels. This approach can widen the range of plastic that can get recycled and boost recycling rates, with the potential to close the entire plastics supply chain loop.

One criticism of chemical recycling, however, is that the recycling process itself can be energy intensive with the possibility of increasing emissions compared to producing virgin materials. There are two solutions to this problem. First, renewable energy needs to be scaled up. Second, Carbon Capture and Storage technology can help effectively lower emissions from recycling. The major challenge here is cost, as scaling up advanced chemical recycling and CCS application can be expensive.

Still, the share of chemical recycling is expected to substantially increase in the next few decades, despite the fact that it accounts for a tiny fraction of total plastic recycling today. Companies such as Dow, LyondellBasell, and BASF all have development programmes for chemical recycling.

- Steam cracking electrification

Steam cracking, the process of breaking down more saturated hydrocarbons such as naphtha, butane, propane, and ethane to less saturated ones like ethylene and propylene, has also become the target of petrochemical companies in their quest to reduce emissions.

The idea of steam cracking electrification is to replace the natural gas that is typically used for heating in a cracking furnace with renewable electricity. The biggest challenge to using renewable electricity is achieving the high temperature of roughly 850 degrees Celsius needed in a furnace. But there are already companies working towards it. In 2022, BASF, SABIC, and Linde started the construction of a large-scale electric furnace in Ludwigshafen, Germany. Shell and Dow announced last year that they had launched an experimental unit to electrically heat steam cracker furnaces at their campus in Amsterdam.

Besides directly heating existing furnaces with renewable electricity, several companies are developing a new technology—a rotodynamic reactor—which requires a furnace to be redesigned to allow feedstock to enter a high-speed rotor and use generated kinetic energy to heat up the furnace. Engineering companies Coolbrook and Linde are collaborating to develop such a reactor with potential partnership interest from companies such as SABIC.

- Synthetic petrochemicals with hydrogen

Clean hydrogen (green hydrogen produced from renewables or blue hydrogen with carbon capture and storage) can be used in petrochemical production either as a fuel for combustion during the steam cracking processes or as a feedstock for synthetic petrochemical products such as methanol.

For steam cracker heating, hydrogen could become an option in the long term, although it would also face competition from other options such as electrification mentioned above. For petrochemical production feedstock, hydrogen is already widely used as an input to produce methanol and ammonia. But since most of the current hydrogen produced is grey, there is a need to decarbonise the hydrogen production process.

Synthetic methanol, an appealing low-carbon alternative, can be produced by combining green hydrogen with carbon dioxide that is captured from emissions elsewhere. Some companies, such as Worley, take it a step further by using biogenic CO2 that is captured from a biomass-fired power plant. This is a nature-based way of taking carbon out of the atmosphere, also called negative emissions. In the future, this might also be done by machines via direct air capture, but this technology is still in its infancy and there are no examples in the industry yet.

Although synthetic methanol is mostly gaining traction in the marine transport sector, it can also be used to produce low-carbon petrochemicals such as solvents and plastics. Still, green synthetic chemicals remain a nascent area that needs significant scale-up to meet the decarbonisation needs of the sector.

The use of green hydrogen to produce synthetic chemicals has great growth potential, as the global cost of unsubsidised green hydrogen is likely to substantially decrease in this decade, becoming competitive with blue hydrogen in the early 2030s and with grey hydrogen around 2040. Green hydrogen is already cheaper than grey hydrogen in China thanks to the country's cheap electrolysers and power costs. Cheap Chinese electrolysers can reduce the cost of green hydrogen in other parts of the world even faster if they are exported to these regions.

Hydrogen still expensive but getting cheaper

Levelised cost of green hydrogen production in dollars per kilogram

Bloomberg New Energy Finance, ING Research

- Carbon capture and storage (CCS)

CCS is gaining attention from petrochemical companies as a technology to reduce emissions from petrochemical production.

Around the world, there have been several petrochemical-related CCS projects, either operating or under development. In China, a 1 Mtpa integrated CCS project came into full operation in August 2022, where carbon dioxide is being captured from the Qilu Petrochemical plant and transported to the Shengli Oil Field to enhance oil recovery. In Singapore, Shell and ExxonMobil's Low Carbon Solutions unit are both looking into regional CCS hubs to capture CO2 from their petrochemical and refining operations in the country. In Europe, Air Liquide and BASF are jointly developing the world’s largest cross-border CCS network in Belgium, the Netherlands and Norway, where 14.2 Mtpa of CO2 is expected to be captured from chemical and hydrogen plants. In the US, the Lake Charles CCS project plans to capture the CO2 generated from methanol synthesis processes.

In addition, CCS has the potential to control emissions from recycling plastics, which can sometimes be energy intensive as well.

Policy: Carrots and sticks are both ramping up, but more is needed

All the decarbonisation pathways discussed above need significant investment to support the scale-up of relevant technologies. The United Nations Environmental Programme (UNEP) recently proposed a Systems Change Scenario, where the inflow of virgin plastics is more than halved and the outflow of mismanaged plastic waste is slashed by 80% by 2040 compared to the Business As Usual scenario. The UNEP estimates that the Systems Change Scenario is not out of reach but will require investment in virgin plastic production to fall by $2.2tn by 2040, with companies and institutions needing to shift $2.6tn of investment into sustainable materials, circularity, and sorting and collection. Mounting decarbonisation demand from investors and end-user companies will facilitate this change, but even stronger policy is required.

Significant investment needed in plastics circularity and sustainability

UNEP estimates of financial flows required to achieve the Systems Change Scenario by 2040, in trillion dollars

UNEP, BNEF, ING Research

Today, both incentives and restrictions are in place among many governments to accelerate the decarbonisation of the petrochemicals sector. In terms of incentives, in the US, the federal Biomass Crop Assistance Program financially supports producers of advanced biofuel feedstock, which can be beneficial to petrochemical companies in demand for such stock. The US Department of Energy is also providing $100mn for research and development for the production of fuel and chemicals from biomass, as well as $60mn to de-risk and accelerate the commercialisation of renewable chemicals and fuel production. It is also important to note that policy support for other clean technologies, including renewable energy, CCS, and hydrogen, will also help the petrochemicals sector reduce emissions.

While the US is leading in providing incentives, the EU is more advanced in establishing regulations to curb the demand for plastics. In July 2021, the EU banned single-use plastic plates, cutlery, straws, balloon sticks, and cotton buds from being circulated in the markets of EU member states. Moreover, the introduction of Single Use Plastics Directive (SUP) in 2019 and the current proposal for the Packaging and Packaging Waste Regulation (PPWR) shape the future of packaging. This will be done by reducing plastic waste and setting out minimum recycled content standards in plastic packaging for 2030 (e.g. 30 % for single-use beverage bottles).

In the US, the Biden administration has set a goal to displace over 90% of the plastics with bio-based materials in the next two decades, although this target has been criticised by some as being too ambitious since it would require a 155-fold increase in bioplastic capacity. And despite the related funding mentioned above, there has not been a federal single-use plastics ban. Efforts are nevertheless happening at the state level, with extended producer responsibility laws passed in Oregon, Colorado, Maine and California.

Efforts from the EU and US show that policymakers are serious about tackling the environmental challenges associated with the petrochemicals sector. But more is needed to spur investment to the level outlined by the UN and to ensure a long-term structural change towards sustainable petrochemical production.