ING Viewpoint November 2021

Steven van Rijswijk, CEO ING Group

Stimulating EU transition financing

Banks have a vital role to play in partnering with governments, corporates and citizens to mobilise the capital needed to successfully finance the unprecedented economic paradigm shift to a greener economy.

However, companies and other economic actors do not become green overnight. Therefore more focus needs to be put on facilitating and measuring the transition.

We need more tools that will allow companies to show that their transition plans are aligned with objective, science based trajectories and that their future investments will bring them a step closer to net zero."

Steven van Rijswijk

CEO ING Group

Introduction

The EU is actively steering its economies to lowering net greenhouse gas emission by 55% by 2030 compared to 1990 levels, and towards carbon neutrality (“net zero”) by 2050. Regulation and guidance is being developed to achieve this goal.

The strength of any climate strategy is founded on measurable targets. Therefore we need EU wide transition pathways showing how specific sectors can reach their climate objectives. Based on these abatement curves an estimate can be made of the volume and costs of reducing emissions, benchmarked against the sector. This is instrumental in assessing individual companies' transition capacity and progress, as it measures the dynamic alignment. It will help support the transition of currently carbon intensive activities given that transition pathways can also be instrumental in providing sustainability linked financing. In doing so, banks will also better align their credit portfolio with climate targets. This is crucial both for managing climate risks and for banks reaching their own net zero goals.

Alongside the establishment of EU sectoral pathways and a disclosure requirement for corporates to show pathway alignment, the development of a Transition Asset Ratio (TAR) for the financial industry should be considered. This would express the share of a bank’s assets that are linked to a credible climate transition scenario despite not qualifying for inclusion in the banks Green Asset Ratio (GAR).

EU sectoral pathways to benchmark the transition

Pathways serve to set intermittent, measurable transition goals, which can be linked to financial products such as loans. This would allow to incentivise greenhouse gas (GHG) reductions (through the terms of a financial product, and provide a tool to measure the GHG impact of loans and other financial products. It helps to improve targets in line with climate science and sectoral developments. This will allow for a proper measurement of “embodied energy/carbon” meaning the amount of GHG emitted when sourcing, producing, processing, transporting and disposing a product.

We believe such EU wide pathways will:

- Improve access to sustainable funding via banks and capital markets

- Standardise sustainable financing instruments, including for companies that operate on a cross border basis

- Help avoid greenwashing, as alignment with scientific pathways can be verified

- Encourage more fit for purpose financing solutions that will contribute to closing the funding gap for the transition

The pathways should be reasonably stable in order to inform (long term) investment decisions and should be developed by an independent authority. The pathways must be scientific in order to achieve clear transition pathways for companies and to serve as a reference point for sustainability linked financing structures and green bonds.

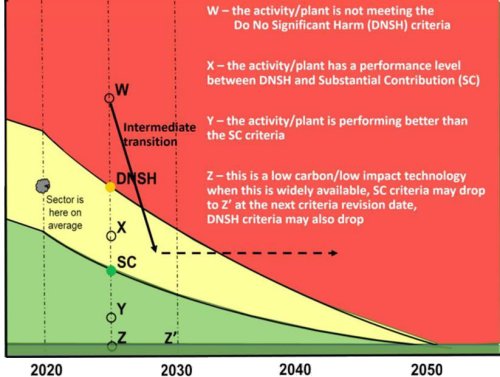

Chart: Example curves for a high impact activity moving to net zero by 2050

Y axis: tCO2

Curve shown is for an environmental objective with a smooth reduction in environmental impact zo zero/very low level by 2050. Source: EC Platform on Sustainable Finance, Public Consultation Report on Taxonomy extension options linked to environmental objectives, July 2021, page 18

It is key to develop such transition pathways at the European level. Although national scenarios allow to account for certain specificities of a particular jurisdiction, they lead to divergent standards, unnecessary complexity, and possibly arbitrage.

We believe these sector specific pathways, in combination with corporate and financial sector disclosures, will contribute better to benchmarking of loans to companies and thus also of the banks’ aggregated balance sheet in the context of climate stress testing and supervisory practises.

The Transition Asset Ratio (TAR) : A way to measure a banks’ transition to green

Benchmarking loans and other financial products to scientific sector pathways will provide a more realistic insight in the transition risks of banks. Especially when banks’ disclosure requirements would allow banks to report on their pathway aligned financing.

- Banks may finance clients/projects that are consistent with a credible pathway to the net zero targets, but that are not reflected in the green asset ratio (GAR). As the GAR only reflects 100% taxonomy aligned assets. Compliance with all criteria, especially those specifying “no significant harm”, will be difficult to prove due to lack of information, particularly on a project/asset basis. For example, a bank heavily financing fossil fuels and another bank being completely divested from fossil fuels may have similar GARs. This would not do justice to the different climate risk profiles of these banks. This illustrates that the GAR will not provide any additional information to the markets while a TAR will add significant insight and allows to steer incentives.

- While one could argue that the GAR is merely a disclosure tool, markets will interpret this differently. A bank with a low GAR may be perceived a higher risk, leading to rating downgrades and higher funding costs. A TAR could provide a more accurate picture of a bank’s profile.

- Fully acknowledging transitional assets in the financial industry’s disclosure provides an extra incentive to finance those activities.

- A bank’s TAR would be disclosed alongside the GAR, and would provide investors and regulators with a clear picture of the bank’s balance sheet.

Conclusion

We recommend to make EU sectoral transitional pathways an integral part of the EU Sustainability framework and to introduce a disclosure requirement that properly captures both green and transitional finance. An EU body could officially “recognise” sector specific transition scenarios developed by third parties, while the European Banking Authority could develop guidance for developing this type of scenarios.