ING Viewpoint August 2017

Koos Timmermans, CFO ING Group

"If banks are able to choose the optimal allocation of funds available internally, cross-border banks in Europe will be able to become truly European.

Removing remaining regulatory barriers in this regard will foster integration, improve balance sheet risk management, and increase financial stability.

As we are transitioning towards full Banking Union, it is important to increase regulatory efficiency whereas at the same time respecting prudential safeguards for all stakeholders involved. We envisage an end state where the Banking Union, with EDIS in place, will allow banks to build prudential buffers at a European group level, with fungible capital and common liquidity and bail-in buffer.

In this context, ING supports the approach taken by the European Commission in its proposed review of the European banking framework in November 2016."

Koos Timmermans,

CFO ING Group

Europe is progressing on the journey towards a full Banking Union. As its three pillars (single supervision, single resolution and shared deposit insurance) are being built, national approaches and deviations to bank regulation should be phased out. Today, a number of important impediments remain to the transfer of assets across borders. The European Commission’s November 2016 proposal on the review of the EU banking framework is an important step in the right direction.

In this viewpoint we lay out why we believe intra-group flows across borders should be encouraged and how this would take the Banking Union project forward, to the benefit of financial stability and competition in Europe’s banking markets.

1. Restrictions on intra-group flows

Freeing up intra-group flows of capital, liquidity and loss-absorption capacity is a crucial factor in the further integration of the Eurozone. Too many restrictions will result in capital and liquidity buffers that cannot be used to support the real economy. Moreover, cross-border intra-group banking flows not only increase efficiency of funds allocation, but also benefit financial stability and risk management. And not least, they are instrumental in fostering competition.

Two elements are particularly important. First, banks that are part of European banking groups should be able to manage capital and liquidity at a consolidated level only so as to facilitate cross-border flows. Second, national discretions should be ironed out so as to remove discrepancies in the application of intra-group large exposure limits.

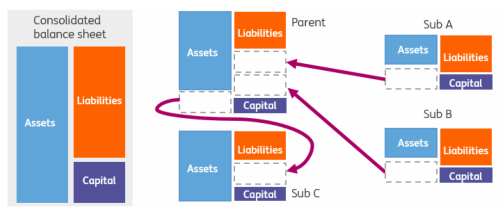

From a bank’s perspective, lifting cross-border restrictions allows for much more integrated balance sheet management, resulting in more efficient and effective use of capital and liquidity. While it is understandable that national supervisors focus on their local jurisdiction, we think it is important to take incremental steps towards a more European approach.

Liquid asset buffers serve the purpose of mitigating liquidity risk (e.g. unexpected outflows) whilst capital buffers serve the primary purpose of mitigating credit and market risks. In the aftermath of the crisis, national supervisors became more keen to control subsidiaries within their borders, promoting ‘self-sufficiency’ by imposing local capital, liquidity and funding requirements and restrictions on intra-group financial transfers.

Liquidity and capital buffers are expensive resources to be put to work in banks. If there are sufficient guarantees that banks have adequate liquidity and solvency positions at all times, by virtue of the SSM, there is no need to trap these buffers unduly at the subsidiary/solo level.

2. Ways to improve the current regulatory framework

When discussing the free flow of funds within banking groups, a distinction should be made between liquidity, capital and loss absorption, as these are the main requirements as per the EU CRD/CRR and BRRD frameworks. We welcome the spirit of the November 2016 EC proposals that aim to facilitate cross-border flows within banking groups. They could be complemented by targeted changes to the regulatory framework that would better operationalise this approach.

- For liquidity, current regulation already offers the possibility to create so-called cross-border Single Liquidity Subgroups. The "C-SLS" concept allows for more efficient management of liquidity buffers within banking groups. The C-SLS concept does not waive local requirements but makes them more proportionate subject to strict conditions. We believe the C-SLS is an appropriate concept that should be applied more extensively within the Banking Union.

- For capital, requirements at the subsidiary level should always be proportionate relative to the consolidated requirement. Secondly, the EC proposed in its CRR review last November that within the Banking Union, solo capital requirements can be waived subject to certain conditions; an important one being that at least half of the solo requirement shall be met with collateralised guarantees. We believe for capital this is a reasonable and prudent approach, though we recommend that 50% should be the maximum collateralisation requirement.

- On TLAC/MREL (bail-in-able debt instruments) the EC proposed that resolution authorities could allow local MREL requirements to be met with the right mixture of collateralised and uncollateralised guarantees, also within the Banking Union. We believe this suggested approach should be maintained.

Intra-group exposures increase financial stability and improve risk management by banks

Intra-group cross-border flows not only contribute to an efficient allocation of funds, they also add to financial stability. While external wholesale sources of funding may be volatile and could evaporate in times of crisis, liquidity available within cross-border banking groups provides a stable source of funding. This creates a cushion preventing against asymmetric shocks in one country from spreading to other parts of the Banking Union. This is important for liquidity, but equally for capital and loss absorbency.

Conversely, as the BIS observes, “ring-fencing” and “subsidiarisation” may constrain the efficient allocation of capital and liquidity within a globally active banking group and the functioning of its internal capital markets; in fact, these proposals have led to concerns that structural banking reforms may potentially trap capital and liquidity in local pools.” This deprives banking groups of an important and stable source of funding wholesale markets.

To avoid that buffers are trapped unduly at the subsidiary level and in order to bolster the policy goal of fostering more integration, EU policy makers could consider the following complementary measures:

- Develop a definition of collateral qualifying for guarantees in the legislation: properly defining collateral eligible for guarantees is key since a significant part of the ‘transferable amount’ would be done through collateralised intercompany loans. Here, it is important that all assets that are central bank-eligible are eligible, which would imply that certain assets that are not considered High Quality Liquid Assets in the LCR framework could be eligible. The use of collateral guarantees for bail-in pre-positioning purpose is to mitigate credit-risk, requiring LCR eligibility for assets that are solely used for credit risk leads to encumbrance of scarce liquidity assets for no good reason.

- Introduce a harmonised exemption for intra-group exposures: amending the CRR to remove national discretion over exempting intra-group exposures from the large exposure limits, and introduce a general waiver for intra-group exposures from the large exposure limits regime. We believe the prudential framework provides for sufficient mitigants and that diverging national intra-group large exposure rules unduly impede the free flow of funds within banking groups.

Conclusion

We need to build on the significant progress that has already been made in the setting-up and implementation of Banking Union and we believe it is important to address some of the elements of the EU’s prudential regulatory framework that are key prerequisites for a fully-fledged Banking Union. The key elements we see are i) eliminating current intra-group large exposure restrictions, ii) allowing for the fungibility of capital, iii) avoiding local liquidity requirements while offering the cross-border single liquidity subgroup as viable alternative, and iv) avoiding prepositioning of loss-absorbency buffers.